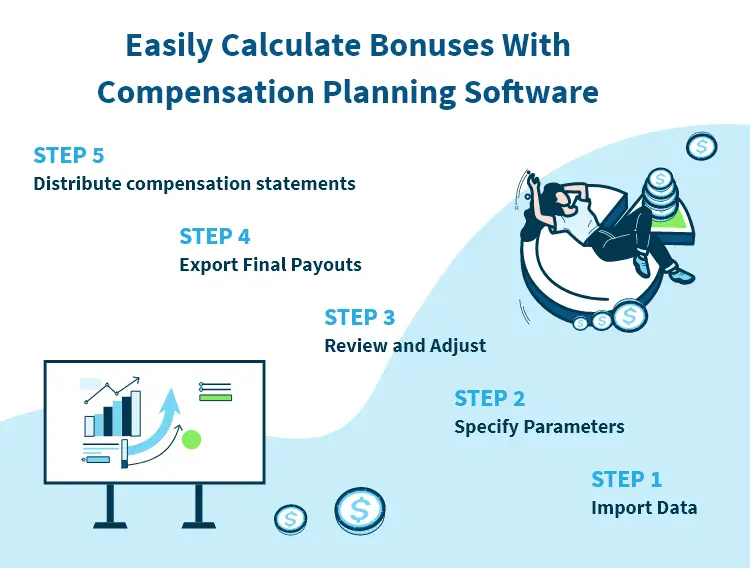

How to Easily Calculate Bonuses with Compensation Planning Software

- Step 1. Import data

- Step 2. Specify formulas

- Step 3. Review and adjust

- Step 4. Export final payouts

- Step 5. Distribute compensation statements

The calculation of prorated bonuses stands as a critical challenge demanding precision and efficiency. Calculating prorated bonuses for employees that join or depart mid-year can be overly time-consuming and error-prone, which emphasizes the need for a solution that simplifies and streamlines the process without compromising accuracy—this is where Salary.com's Compensation Planning Software takes the spotlight.

In this article, we'll break down some challenges related to calculating prorated bonuses and showcase how Compensation Planning Software is changing the game, making compensation planning more straight forward and efficient for all parties involved. But before we get into the main part, let's recap prorated bonus meaning, examine examples, and discuss how to calculate them for your employees.

What is a Prorated Bonus?

So what does prorated bonus mean? A prorated bonus is a bonus that is adjusted based on the time or performance of the recipient. The incentive is often given to eligible employees who have worked for a partial duration of a specified bonus period.

Fun fact: The term "prorated" is derived from the Latin phrase "pro rata," which translates to "in proportion."

To calculate a prorated bonus, determine the full bonus amount for the period. Then identify the portion of time the employee worked within that period. Multiply the proportion of time worked by the full bonus amount to find the prorated bonus.

For example, if an employee has worked for only half of the bonus period, their prorated bonus would be half of the total bonus amount. Note: You need a prorated bonuses calculator for an accurate result.

Prorated bonuses are commonly used to ensure that employees are fairly compensated based on their actual contribution or time worked within the bonus period. It can be also useful when you have employees who join or leave the company in the middle of a performance period, when employees get promoted or change positions within the period, or when you have employees who work part-time or on a variable schedule.

How to Calculate a Prorated Bonus?

To determine an employee's prorated bonus, use a prorated bonuses calculator or formula. But first, it's important to note that the incentive is derived from three key factors:

-

Work Duration

This factor represents how long an employee has actively worked during the bonus period, whether in days, weeks, or months.

-

Bonus Period Duration

This is the total length of the bonus period being considered. It sets the context for the employee's contribution and can be measured in days, weeks, or months.

-

Total Bonus Amount

This is the promised bonus an employee gets for meeting conditions and working the full bonus period, often a fixed amount, a percentage of salary, or tied to performance metrics.

Now, apply the prorated bonus calculator or formula/s:

Prorated Bonus = (number of days worked ÷ total days in bonus period) x total bonus amount

OR

Prorated Bonus = (number of weeks worked ÷ total weeks in bonus period) x total bonus amount

OR

Prorated Bonus = (number of months worked ÷ total months in bonus period) x total bonus amount

The fraction (number of days worked ÷ total days in bonus period) calculates the proportion of time the employee has worked during the bonus period. Multiplying this by the total bonus amount gives the prorated bonus amount.

Tip: Remember to use consistent units for the "number of days worked" and "total days in bonus period" (for example, if you're calculating a monthly bonus, both values should be in days).

Using the same units ensures accurate calculations and a fair distribution of bonuses for the specified time frame. It also avoids potential discrepancies that may arise from using different time units.

Examples of Prorated Bonus

Let's consider these examples to illustrate the calculation of a prorated bonus using the prorated bonus calculator:

-

Scenario 1

John recently assumed the role of Human Resource Assistant. With an annual salary of $45,840, he began his tenure in January and contributed actively until October. Let's say his company offers an annual incentive equal to 10% of an employee's annual salary.

Now, as we calculate John's prorated bonus, given that he worked for 10 months out of the 12-month bonus period, we can apply the prorate bonus calculator or formula:

Work duration: 10 months

Bonus Period Duration: 12 months

Total Bonus Amount: $4,584 (10% of John's annual pay)

Prorated Bonus = (10 ÷ 12) x $4,584

= 0.8333 x $4,584

= $3,819.8472So, in this scenario, John's prorated bonus, given that he worked for 10 months out of the 12-month bonus period with a total bonus amount of $4,584, would be $3,819.8472.

-

Scenario 2

Maria, a dedicated public school teacher, has been serving tirelessly throughout the academic year. With an annual salary of $57,388, Maria has decided to depart mid-year. As we calculate Maria's prorated bonus, acknowledging her tenure of working for 6 months out of the 12-month bonus period, she can expect:

Work duration: 6 months

Bonus Period Duration: 12 months

Total Bonus Amount: $5,738.8 (10% of Maria's annual pay)

Prorated Bonus = (6 ÷ 12) x 5,738.8

= 0.5 x 5,738.8

= $2,869.4Here, Maria will receive a prorated bonus of $2,869.4, reflecting her half-year commitment during the 12-month bonus period.

Challenges of Prorated Bonus Calculation

The challenges of prorated bonus calculation revolve around several key aspects in the compensation process. Here are some of them:

-

Determining the Eligibility Criteria

Different incentives have varying eligibility criteria, such as the required duration of employment or specific performance benchmarks. These criteria are contingent on company policy, bonus plans, or employee contracts.

-

Choosing the Proration Method

Choose a proration method—whether by days, weeks, months, or hours—that aligns with fairness and accurately reflects bonus amounts. Considerations include accounting for variations in working hours or days per week among employees.

-

Handling Special Cases

Adjustments may be necessary for unique scenarios, such as employee leave, salary changes, promotions, department transfers, or variable schedules. Employers or managers may need to exercise discretion and flexibility in such cases.

-

Communicating the Bonus Calculation

Transparent communication of the reward calculation to employees is essential to prevent confusion and disputes. Documenting and explaining the calculation in the employee handbook, bonus plan, or contract, and confirming it with employees before payout, fosters trust and engagement while avoiding dissatisfaction.

Easily Calculate Prorated Bonuses with Compensation Planning Software

Calculating prorated incentives is simplified through Compensation Planning Software—you don't need to manually calculate employees' incentives using a prorated bonus calculator, as it automatically performs the calculations for you.

It's a powerful tool that effortlessly aids in managing your compensation planning and budgeting processes. Here's a quick overview of this product:

What is Compensation Planning Software?

Compensation Planning Software merges spreadsheet familiarity and flexibility with cloud computing's automation, workflow, and security capabilities. Compensation Planning supports managing merit raises, bonus, commissions, long term incentive awards, equity, and employee total rewards statements across an entire organization. You can keep all the benefits of your planning templates and spreadsheets while eliminating the administrative burden of manual compensation planning, reducing cycle times and errors in a secure workflow. Say goodbye to tedious workbook inspections, emailing compensation data, and juggling workbooks across divisions.

Now that you know how the tool can help you calculate the prorated bonuses for your employees, here is a step-by-step guide on how to use this tool:

-

Step 1: Import Data

Import your employee and compensation plan details into the Compensation Planning Software. You can use the familiar Excel-like formulas or the software's formula engine to define your bonus calculations within its spreadsheet. Its mouse-over feature provides easy access to information, including salary histories, and minimizing the planning view size.

-

Step 2: Specify Parameters

Once your data is imported, specify the start and end dates of your performance period, as well as the eligibility criteria for your employees. The Compensation Planning Software will automatically calculate the number of days each employee was eligible for the bonus and apply the appropriate proration factor. Managers can also input performance-based recommendations for each employee, if necessary.

-

Step 3: Review and Adjust

Review and adjust the bonus amounts as needed. You can use the software's reporting and analytics features to monitor your budget, compare scenarios, and identify outliers or errors. Compensation Planning Software should also enforce your compensation business rules within the tool through automated hard and soft stops.

-

Step 4: Export Final Payouts

Export the final bonus payouts amounts to your payroll system. You can also generate and distribute bonus letters or Total Rewards Statements to your employees using Compensation Planning Software. The software writes reports, allows companies to customize employee statements, and enables managers to have important conversations at the end of the planning process.

-

Step 5: Distribute Compensation Statements

Send out the finalized compensation statements to employees, ensuring transparent communication of their bonus payouts and any relevant details. You can leverage the software's feature to create a proactive communication plan that involves employees through timely emails before and during the distribution of reward statements.

Getting accurate prorated incentives using a prorated bonuses calculator can be challenging, given that this process is time-consuming and error-prone. Fortunately, with Compensation Planning Software, you no longer need to endure tedious manual calculations for prorated bonuses. This tool streamlines your calculation process, making it efficient and error-free with just a few clicks.

Insights You Need to Get It Right